Overview

I’ve always found it frustrating that a credit card number is static – in other words it can not easily be changed by the owner to prevent duplication by anyone with access to the card (i.e. waiter, convenience store worker, etc).

Today I re-discovered that some Citi Credit cards have the option of generating separate virtual credit cards for use on individual purchases (this option was removed at one point). This is a great boon to security – especially when needing to make a purchase from a ‘less than reputable’ site online.

Below we will look at my two favorite options for creating virtual credit cards, and then we will take a look at the benefits of using these virtual cards:

Option 1: Privacy.com

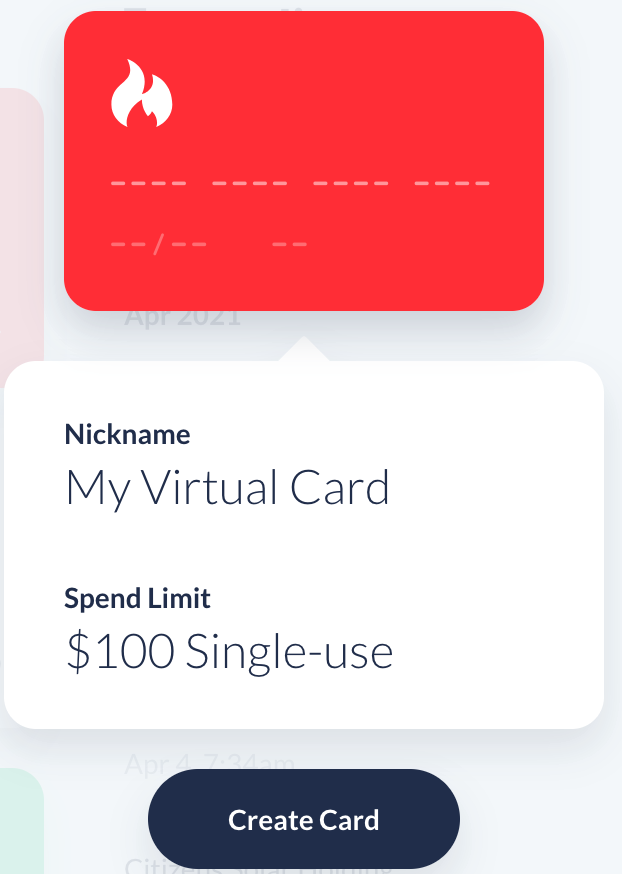

There may be other similar services, but I’ve enjoyed using the free service of Privacy.com (This is a referral link) to generate virtual credit cards. Use cases may include scenarios like:

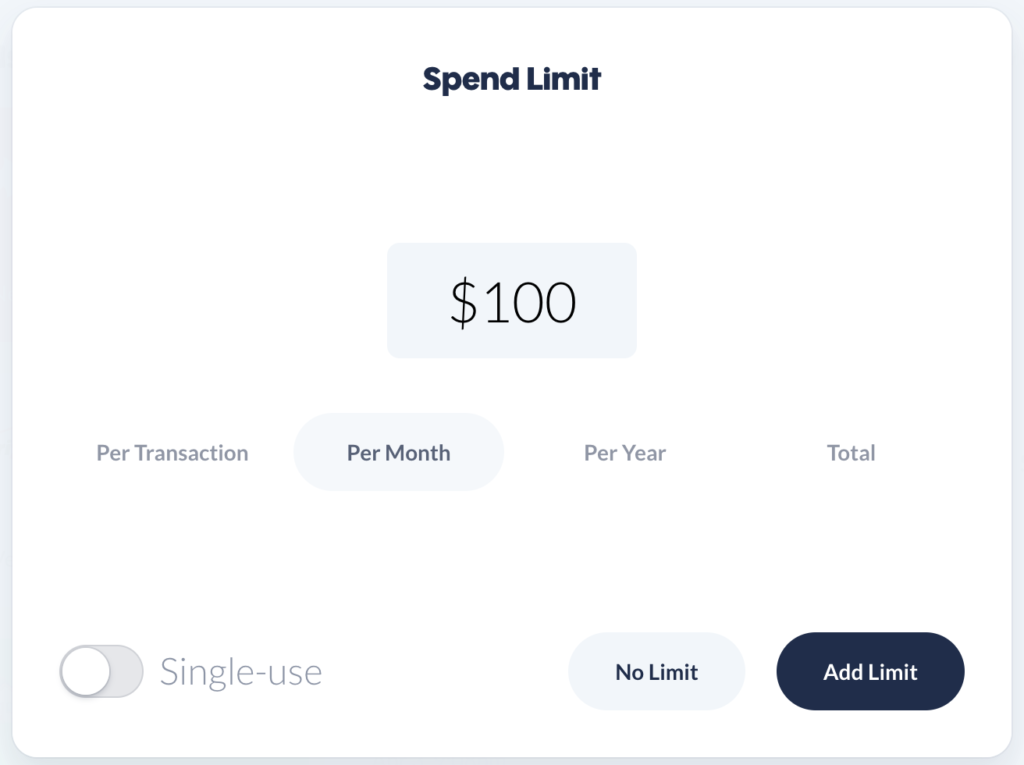

- Limit a subscription service to a certain amount each month – and if they raise the cost, the auto-payment will fail.

- Create a one-time use credit card for one-off purchases

- Keep your own bank from knowing what you purchase (all they see is that you purchased something from privacy.com!

How do they make their money?

If you’re wondering how they make their money, they take the place of the Credit Card Companies and charge the vendor a small fee (You don’t incur any additional charges).

Requirements to use Privacy.com

It requires you to provide the details of your debit card or a checking account.

How it works

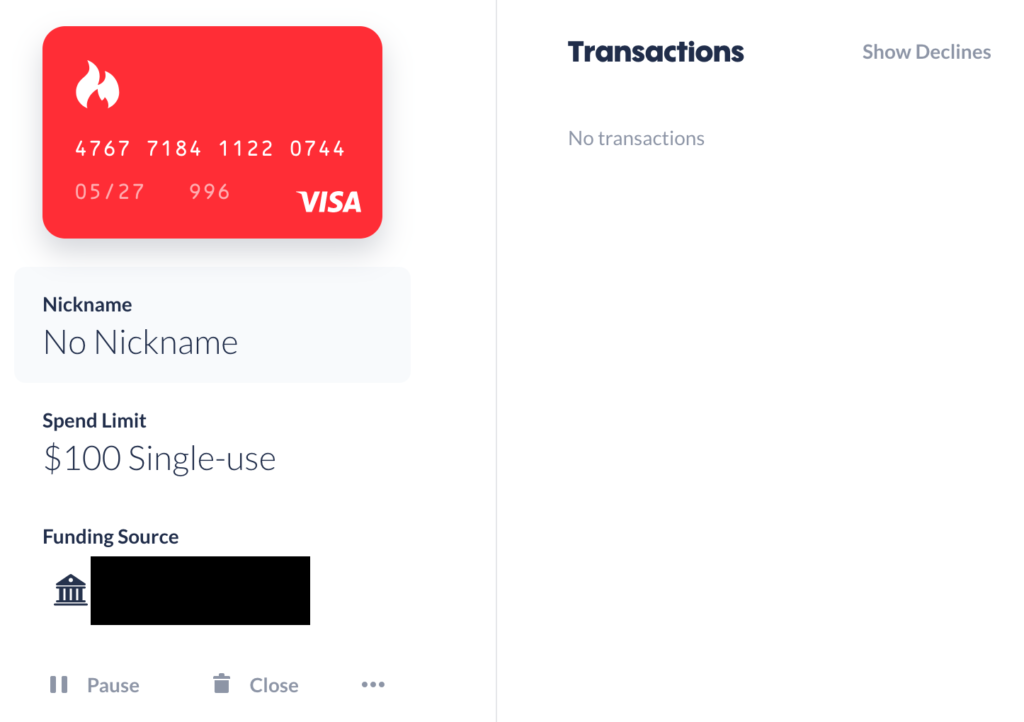

Using the Privacy.com website, a mobile App, or a browser extension (the most useful), you can generate any number of virtual credit cards with various parameters. The browser extension is the most useful because it will automatically detect credit card fields and auto-generate a card for you and fill the credit card fields automatically (It’s like magic)!

Yes, I realize that I’m giving up some privacy in handing over my debit card information to privacy.com, but I personally find it a worth-while trade off.

Option 2: Virtual Account Numbers

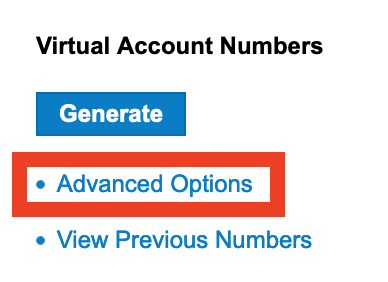

This option is dependent upon your Credit Card provider having this feature. Currently I know that CitiCard is working on an improvement to the usability of generating virtual card numbers. There is an existing method but it is rather clunky, outdated, and not very quick since it requires you to be logged into the CitiCard website to generate each virtual card number:

Benefits of Virtual Credit Cars

- You can close the virtual card at any time or modify the spending limit.

- If you are asked for a name/address when using the card, you can enter anything and the card won’t be rejected! (Privacy.com cards only)

- There are small cash-back bonuses when using the privacy.com cards.(Privacy.com cards only)

- When purchasing using a Privacy.com virtual card, even your own bank (issuer of the debit card) won’t know what, or from who you are purchasing! The transactions will show up in your bank like: